How Do You Know When Your Tax Refund Is Coming

Check your refund status online 24/vii!

Bank check your refund status online 24/7!

- Select the tax year for the refund condition y'all want to check.

- Enter your Social Security number.

- Choose the form y'all filed from the drib-down carte.

- Enter the amount of the New York State refund y'all requested. See Refund amount requested to learn how to locate this amount.

Note: To check the status of an amended return, call usa at 518-457-5149

Cheque refund status

Para español, llámenos al 518-457-5149—oprima el dos.

- Linguistic communication:

- English

- Español

- 中文版

- Русская версия

- বাঙালি

- Kreyòl ayisyen

- 한국어

- Free interpretation services

Understanding your refund status

Equally you track the status of your return, you'll see some or all of the steps highlighted below. For more data about your status and for troubleshooting tips, meet Understanding your refund condition.

Desire more information almost refunds? Come across these resources:

- Respond to a letter

- Your refund was adjusted

To receive a notification when your refund is issued and other electronic communications about your income tax refund see Request electronic communications from the department.

We do not accept any data about your return at this time. E-filed returns could accept one calendar week to post to our system; mailed returns tin can accept up to three weeks to mail to our organization. If you e-filed, cheque your email, taxation software or tax preparer to ensure it has been accepted.

This refund condition volition continue to brandish until your return posts to our arrangement; then you will go an updated status.

We have received your render and information technology is beingness processed. No further data is bachelor at this fourth dimension.

This is a general processing status. Unless your return is selected for additional review, or we asking additional information, this will be your condition throughout processing until we schedule an issue date and update your condition at that time. While your return is in this stage, our Call Centre representatives have no farther information available to aid you. As your refund status changes, this message volition automatically update in our automated phone arrangement, our online Cheque your refund condition awarding, and in the account information available to our representatives.

We received your return and may require further review. This may event in your New York Land return taking longer to process than your federal return. No farther information is available at this time.

In one case nosotros receive your render and begin to process it, our automated processing organisation scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing once more, or you lot may receive a request for additional data. Your return may remain in this stage for an extended period of time to allow united states of america to review. Once you render to the processing stage, your return may be selected for additional review before completing processing.

When we upshot a refund, we will deliver one of the following messages.

- Your return has been processed. A direct deposit of your refund is scheduled to exist issued on (engagement mm/dd/yyyy). If your refund is not credited to your account inside 15 days of this date, check with your bank to detect out if it has been received. If information technology'due south been more than than 15 days since your direct deposit issue engagement and y'all haven't received it nevertheless, see Direct eolith troubleshooting tips.

- Your refund check is scheduled to exist mailed on (mm/dd/yyyy). If you lot accept non received your refund within 30 days of this appointment, call 518-457-5149.

Request electronic communications from the department

The all-time mode to communicate with the Taxation Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive hereafter communications in the Bulletin Centre of your Online Services Account Summary homepage, create your business relationship now, earlier filing your adjacent return.

- LOG IN

- create account

Once you've logged in to your Online Services business relationship:

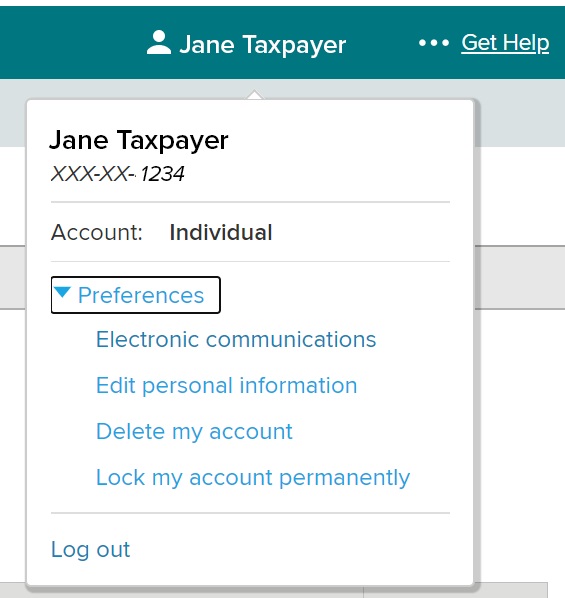

- Select your name in the upper correct-hand corner of your Business relationship Summary homepage.

- Select Preferences, then select Electronic communications from the expanded carte du jour.

Sample of Individuals account type in Online Services

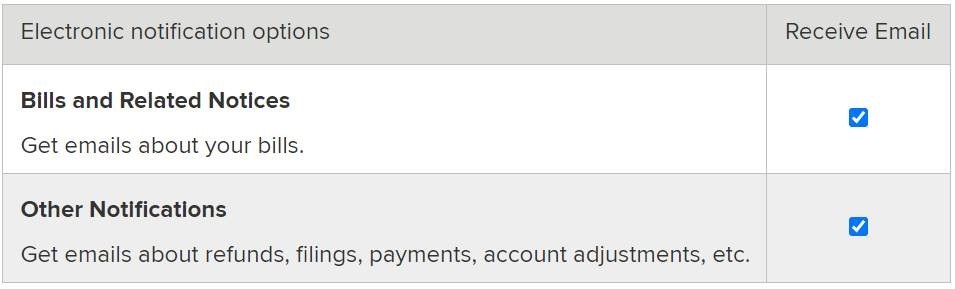

- Cull the Electronic notification options you want to receive email well-nigh. To receive a notification when your refund is issued and other electronic communications about your income tax refund, select both options.

Sample of Bills and Related Notices screen in Online Services.

- Read the Acknowledgement section.

- Select Save.

Updated:

Source: https://www.tax.ny.gov/pit/file/refund.htm

0 Response to "How Do You Know When Your Tax Refund Is Coming"

Post a Comment